Dave Williams had only just retired from his job in sales when he turned the key on a new career behind the wheel.

At 67, he laced up his shoes, combed his silver hair and fastened his seatbelt as a school bus driver.

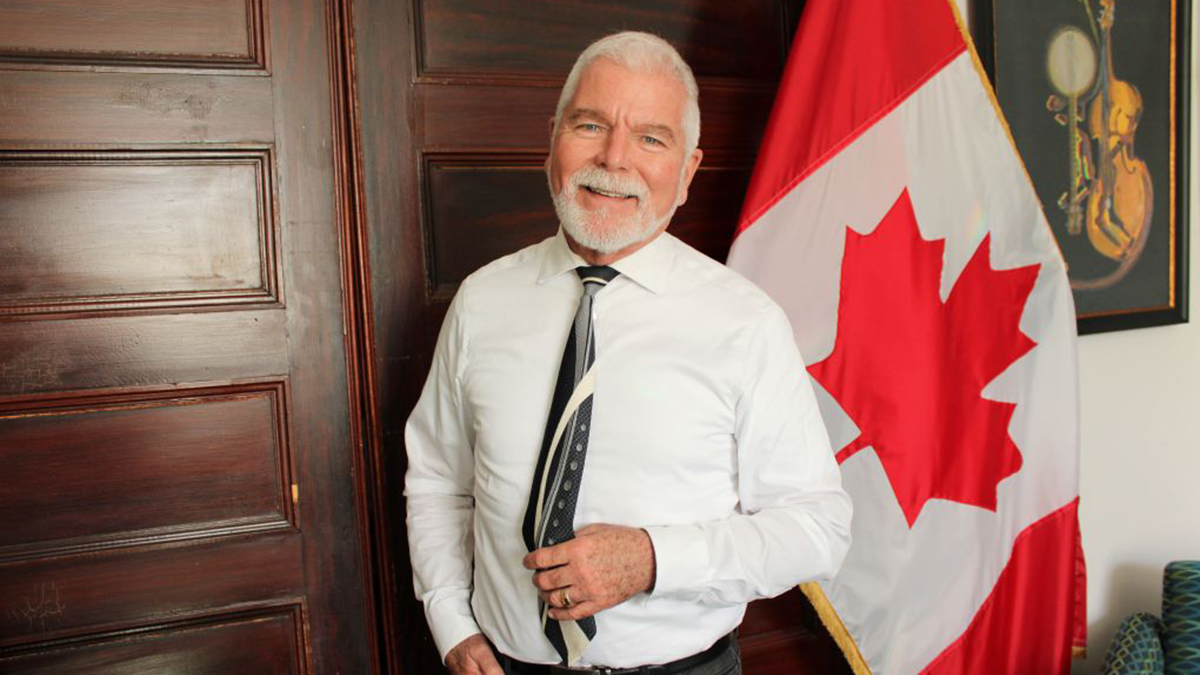

What was meant to be a part-time job evolved into five years of driving buses, trucks, limousines, and even hearses. Now 72, he says his energy skyrocketed a year ago after landing a job as the chauffeur to the high commissioner of St. Kitts and Nevis.

Williams’ retirement, which might be better understood as a career change, has been one of finding purpose and a joie de vivre.

He’s not the only person his age still working.

Since 2021, people over 65 have been increasingly participating in Ontario’s workforce, according to Capital Current’s analysis of Statistics Canada’s Canadian Labour Force Survey.

The unemployment rate for people older than 65 has decreased steadily since 2020. In the last year, the employment rate for this age group has risen from 14 per cent to 14.6 per cent. This is on par with the delay in Canada’s average retirement age.

Experts suggest several reasons. First and foremost, life expectancy has doubled over the past 100 years from improvements in healthcare and quality of life.

Many people also don’t want to give up their intellectual engagement, social circles and routine. And several decades of reduced income is another worry.

“We live a lot longer than we used to. We need to have things to do and money to do those things,” says Laura Tamblyn Watts, CEO of CanAge, Canada’s national seniors’ advocacy organization.

Because of life expectancy, the government doesn’t necessarily want everyone over 65 fully reliant on a pension, said David Gray, a uOttawa economist, who specializes in labour market discrimination, and early retirement. He has also consulted for Employment and Social Development Canada.

“They want senior citizens to earn as much money as possible from wherever [so] there’s less pressure on them to enrich public pension benefits,” Gray says.

Each month, an individual delays receiving their federal retirement pension, it increases by 0.7 per cent. In other words, a contributor receiving their CPP at 70 receives an annual pension 42 per cent higher than if they took it at 65, according to the Canadian Government’s Pension Plan system.

“They have a pension, but there are incentives for them to work, particularly part-time. They would get to keep most of their employment income.”

Pensions are not distributed equally among Canadians. They vary based on factors like citizenship, duration of employment, employment type and sector. An individual must be at least 60 years old to qualify for a pension.

Tamblyn Watts adds that the aging population’s income primarily consists of pensions, savings and government cheques. Coupled with the generation’s high levels of debt and low savings, many can’t afford a few decades without a supplementary income.

“I think a really profound fear people have is outliving their money,” she says.

From 2019 to 2023, the total value of debt for persons over 65 living alone or with a non-relative, increased from 43,007 to 57,512, according to a 2024 Assets and Debt report.

Tamblyn Watts says the specialized and pricey needs of aging populations, such as additional care, medications and transportation, should also be considered for the continued motivation to work and that retirement should be measured by “stage, not age”.

“The notion of what is an appropriate retirement age or a traditional retirement age is frankly nonsense. It’s all made up. And the underpinnings to what people’s needs are have almost nothing to do with those numbers.”

A common need, she adds, is purpose. Leaving the workplace means abandoning status and routine contributions to an individual’s social circle, workplace and the greater community.

Living without these was bleak, Williams said. Returning to work gave him something to do, someone to contribute to, and a sense of routine.

“There’s a lot of people that just let themselves get old,” he says. “I’m not that guy.”

Instead, he puts on a tie, drives a stylish black car around town, and infuses the High Commission with a youthful flair.

“Retirement is not a word in my vocabulary. There’s a lot of people out there who would just jump at the opportunity, but not me — I want nothing to do with it.”