The tech giant Facebook, now known as Meta, is investing heavily in the blockchain technology behind the Bitcoin cryptocurrency and NFT digital collectibles. And according to CEO Mark Zuckerberg, the future of the social networking company will be about helping people build interconnected sets of experiences that bring the “metaverse” to life.

The metaverse, the next generation of the internet, is a virtual environment that will allow people to be present with each other in digital spaces, says Zuckerberg.

Meanwhile, as the metaverse moves from possibility to reality, the current rise of digital spaces and crypto currencies has resulted in an increasing number of artistic creators selling their work under the umbrella of non-fungible tokens or NFTs.

Those interested in buying can purchase NFTs using cryptocurrency, usually with Ethereum (ETH), a popular brand of virtual money.

“Imagine, you come over to my digital world and you get to see all my digital pieces of art — that would create a sense of appeal.”

Aws Al-Hasani, co-founder of Montreal in-game transactions company Auxium

A non-fungible token is a distinctive digital identifier that is attached exclusively to an asset, such as a digitized work of art or a video clip of a memorable moment in an NBA basketball game. You can’t exchange one NFT for another, and each is a unique piece with its own price, making NFTs particularly valuable as one-of-a-kind virtual objects.

One downside is that NFTs take the form of public digital files that anyone can view. But just like you can take a picture of a famous painting and search it at any time, you don’t own the painting.

When you buy NFTs you don’t just own the file, you also gain the right to sell the NFT, display it online, or take advantage of features associated with the asset. Just like investing, you can sell the asset later for profit in the form of ETH.

A Reason.com article says: “It’s supposed to tell the world: ‘I own this.’ “

NFTs designed by their creator can also be presented in the form of GIFs, memes, tweets, music or digital trading cards.

The restaurant chain Taco Bell, American rap star Snoop Dog, British model and actress Cara Delevigne, U.S. YouTuber Logan Paul and even New York Times technology columnists have all sold NFTs.

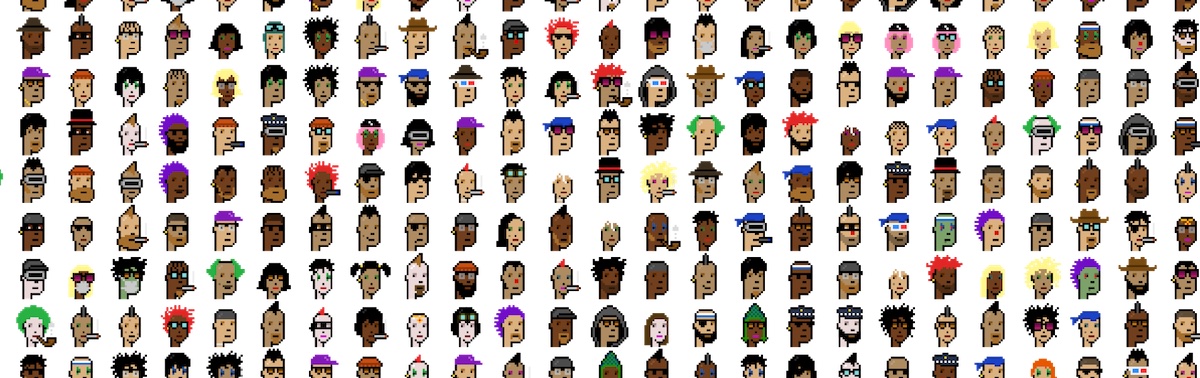

CryptoPunks, developed by Larva Labs, are a series of 10,000 images now sold as NFTs. The CryptoPunk is generated from a list of attributes, which means that there is more than one design (humans, gorillas, aliens, etc.).

Originally, the CyrptoPunks could have been claimed for free by anyone with an ETHwallet in 2017, but all 10,000 were quickly claimed as owned objects almost four years later.

As of Oct. 28, the top price paid for a CryptoPunk NFT was 124.46K ETH, translating to $532.41 million US, for a green-eyed, frizzy-haired, pixellated brown-faced character (though there are questions about whether the seller and buyer are the same person).

The second-highest selling CryptoPunk went for $7.57 million.

The fanfare around CryptoPunks is because they are one of the oldest NFT products that exist and the first to fully click with the crypto community.

Celebrities and influencers have shown great interest in CyroptoPunks ownership. Shawn “Jay-Z” Carter, the American music producer and rapper, purchased CryptoPunk 6096 for more than $120,000 worth of ETH. Currently, he uses this image as his Twitter profile picture.

Gary Vee, entrepreneur and influencer, owns 59 CryptoPunks, including Ape Punk 2140. He bought his Ape Punk 2140 for more than $3 million, which is the seventh highest sale by ETH value at 1.6K in ETH, translating to $3.76 million.

According to Aws Al-Hasani, co-founder of Auxium, an in-game transactions company in Montreal, the draw of NFTs is the “psychology of ownership.” People want to know they own something.

“Imagine, you come over to my digital world and you get to see all my digital pieces of art — that would create a sense of appeal.”

Andreas Park, an associate professor of finance at the University of Toronto, says there’s literally no limit to what NFTs can be.

Potential uses for the “tokens” are nearly limitless, and can possibly provide proof of ownership of assets such as cars, real estate and more. Park says the advent of NFTs could change how we think about ownership.

“There’s a large variety of ways we can use this in the digital world, some of these I can’t imagine now . . . It’s like the internet. People couldn’t really envision any way you could use it profitably for a while.”

Many consider cryptocurrency and NFTs a scam, and entire subreddits have been created to share common feelings.

There is also an ecological cost to buying and selling NFTs.

A single ETH transaction is estimated to have an energy-consumption footprint of 35kWh, according to the Ethereum Energy Consumption Index. That footprint is roughly equivalent to a European resident’s electric power consumption for four days, according to an article by Dr. Memo Akten, a creative technologist in London.

“An ETH transaction is thousands of times more costly than other interest activities that individuals typically engage in,” says Akten.

All digital activity — from sending an email to watching Netflix for an hour — produces CO2 emissions from the cooling of network servers and other activity required to sustain the global web of electronic communication. But, argues Akten, the multi-layered encryption involved in the blockchain technology behind NFTs involves a much bigger CO2 footprint.

NFTs can involve multiple transactions. These including minting, bidding, canceling, sales, and transfer of ownership. All of this puts the footprint of a single NFT into energy use equivalent to hundreds of kilowatt hours and kilograms of carbon emissions.

Of the 18,000 Akten has analyzed, the average NFT had a footprint of 340 kWh. This number is equivalent to an EU resident’s total electric power consumption for more than a month and is equivalent to driving for 100 kilometres, flying for two hours, boiling a kettle four and a half thousand times, using a laptop for three years, or using a computer for 10 months.

“This energy consumption," says Aketen, "is simply for the act of using Proof-Of-Work (PoW) based blockchain, that was designed deliberately to be so compute-intensive, to keep track of bids and sales."