In early February, the Fitness Industry Council of Canada, for the third straight year, implored governments to make gym memberships tax deductible.

“FIC continues to meet with both the (federal) Liberal government and the opposition on the importance not simply of physical activity, but of the work done by the fitness industry in Canada,” Council President Sara Hodson said on behalf of her organization that represents about 6,000 facilities with six million members.

The FIC wants gym memberships considered a deductible medical expense, showing up on Line 33099 on the federal tax form, because they promote physical activity and that alleviates some of the strain on the health-care system. Meanwhile, a deduction for the cost of a gym membership as a fitness expense is proposed for provincial tax returns.

‘If exercise could be bottled, it would be the most effective prescription drug on the planet. It is time to make this accessible for all Canadians.’

— Sara Hodson, president, Fitness Industry Council of Canada

“This fitness tax deduction will draw attention to what the fitness industry has to offer and stimulate economic regrowth,” the FIC proposal states.

While the bid to secure a new financial incentive to get fit is still in the works, at least one gym user in Ottawa says exercise has had a positive impact on his health and that a tax credit for gym memberships would be a good idea for Canada.

Alex Tremblay, 20, goes to his local Fit4Less in Orleans at least five times a week.

He said he’s also met others at the gym who’ve talked about how exercise has changed their quality of life.

“Once you get in the groove of it, it’s hard to stop. I’ve met some people that tell me how they started out, how they were in bad shape, and completely turned themselves around,” said Tremblay.

He said he thinks a fitness tax credit might motivate some people to join a gym.

“Starting out can be intimidating, trust me, but I think that if you had something like this it could give people that little push they need,” he said.

Carleton University student Simon Peacock said he works out about six times a week.

He said he’d also like to see Canadians getting more motivated to get physically active and a tax break to join a gym would help.

“I think people use excuses to not go to the gym. ‘I can’t pay for it, I can’t afford it’. This would break down a bunch of those barriers,” said Peacock.

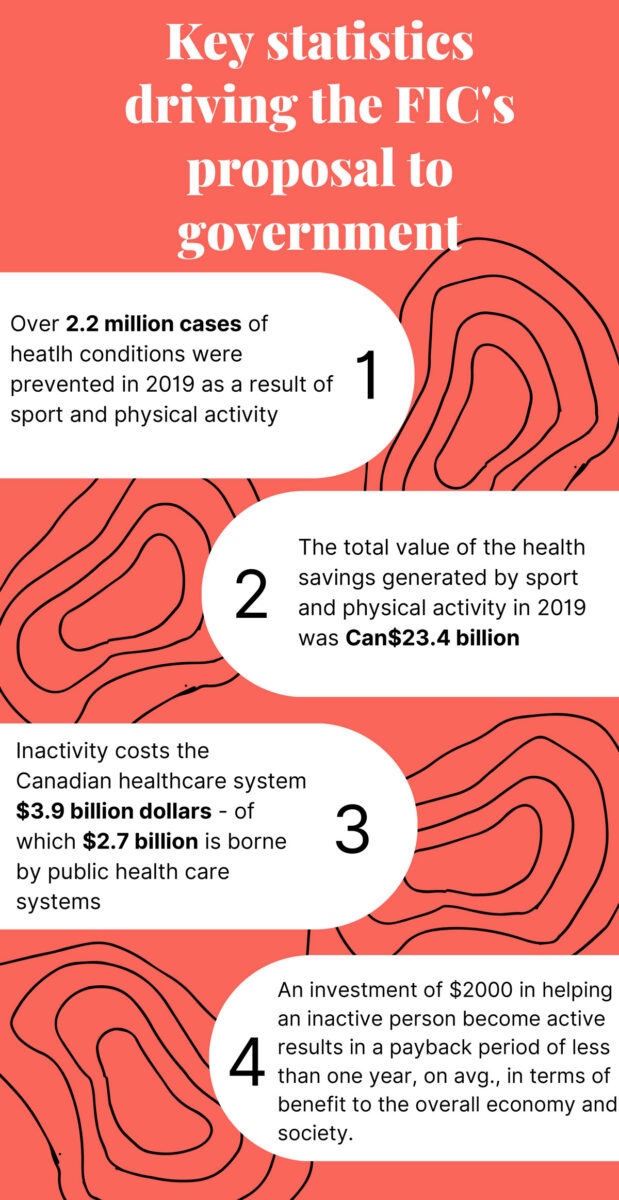

A 2019 report published by the FIC in partnership with 4Global and the Sheffield Hallam University stated that “over 2.2 million cases of health conditions were prevented in 2019 as a result of sport and physical activity, including over 600,000 each for coronary heart disease, Type 2 Diabetes, and depression.”

Peacock said he credits the time he spends working out every week for helping his mental health.

“If I find that, for a week or two, that I’ve been down a bit more, I always find that I haven’t been able to make it to the gym. It’s just part of a regular routine,” he says. “The other thing is that I go in the morning, so starting your day by accomplishing something always makes for a more productive day. I think that if everybody was able to do that, everybody would feel a lot better about themselves. They would feel a lot prouder and more accomplished.”

According to a 2022 report by the Global Health and Fitness Association, “inactivity costs the Canadian healthcare system $3.9 billion – of which $2.7 billion is borne by public health systems.”

Joe Allan, divisional manager with GoodLife Fitness in Ottawa, said its gyms have seen a “strong return” since the end of pandemic closures and that a fitness tax credit would be a “positive step” in the right direction for Canadians to take care of their health and wellness.

“(We) continue to encourage any initiatives that make physical activity part of the preventative healthcare solution. More people accessing gyms is a strong step toward a healthier population,” he said in an email statement.

In 2021, Newfoundland and Labrador announced households could claim $2,000 on any fitness related activity, from children’s’ sports to gym memberships.

While the FIC is still working to obtain a similar financial incentive for the rest of Canada, those focused on fitness trumpet the benefits.

“Healthy bodies mean healthy minds,” said Peacock.

Physical activity remains an essential part of a healthy lifestyle, the FIC insists. The council recommends Canadians should get in 150 minutes of physical activity weekly to maintain a healthy lifestyle and reduce rates of many illnesses from heart disease to cancer.

“The power of physical activity to change our lives, reduce healthcare costs, improve mental health, reduce rates of absenteeism and make a healthier, more vibrant Canada is astounding,” Hodson says. “If exercise could be bottled, it would be the most effective prescription drug on the planet. It is time to make this accessible for all Canadians.”

This would only be equitable if it would allow for people who live rurally to purchase active equipment. Or for people to be active outside of gym and group settings to receive the tax break. I mountain bike solo or with my partner. I freeclimb. I wilderness hike, kayak, canoe, snowshoe, swim outdoors and much more. None of which is covered under any proposal, but certainly as active as anyone urban in a gym. I have ZERO interest in a gym and gym culture, even if the nearest one wasn’t over 50km away. But that tax incentive could help towards cycling gear, paddles, snowshoes, skis, climbing shoes, safety gear etc., etc..

Considering it’s free to go for a jog outside, hike, or do bodyweight resistance training, I don’t think my taxes need to be doing into gym owners’ pockets

What they said. Seems like a great deal for the gym owners, not so much for the people who are lead into believing they need to go to a gym to get fitness

It’s b.s, more corperations would buy in for employees but same amount of people would actually use it